Treasury Operations

Tools Used in Identifying Opportunities

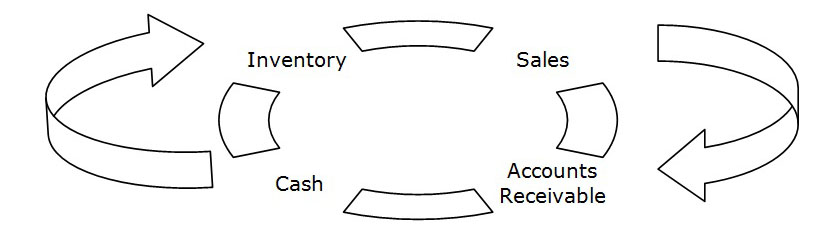

Treasury Operations is fruitful ground for performance improvement by utilizing data mining, predictive modeling, and optimization tools and techniques. Cash recaptured from working capital (excessive receivables, bloated inventory, foregone discounts, and high operating expenses) is money that can be used more effectively somewhere else – in debt reduction, in growth through acquisitions or expansion of plant and equipment, in research and development, etc. Or, creating a cash buffer for a rain day or protection from a challenging credit climate.

Ignoring working capital management can be a recipe for disaster. Resorting to quick fixes (delaying payments or pushing customers into collections prematurely) can result in vendors raising prices and angry customers. Freeing up working capital the right way may be one of the most viable sources of fresh cash.

ACG has developed the metrics and models used to measure free cash flow from operations as well as techniques for freeing up the cash flow. Trend analysis of the cash flow sources and uses identifies the area(s) of greatest concern and focus for further analysis, reporting, model building and solution discovery.

Breadth of Analysis

Data Mining techniques incorporate transactional and customer related data into an analysis of the day-to-day management of the company’s working capital. It is the insights gained from these metrics and their analysis that will help treasury to take specific actions to improve cash management and reduce credit losses. Scoring the AR portfolio using statistical modeling to assess payment risk and collectability is one example of using these techniques and analysis tools.

Areas of Investigation and Our Method of Analysis

There are a number of treasury areas where performance improvement and analysis have proven to be beneficial with consistent results across a wide range of industries. The insights gained from these analyses and models have enabled our customers to make better, quicker and more profitable decisions.

As a result of our client work, we have developed metrics and modeling tools to improve the performance of a number of treasury functions (sample list is shown below). Because of our prior work, we are able to provide results faster because much of the complexity of developing metrics, analyses and models has already been accomplished. As a result, these pre-built tools serve as a starting point for most of our new client work.

The following details our process:

• Determine the area(s) of need (accomplished by our understanding of your unique situation aided by our Diagnostic Tools),

• Identify what data is relevant, select the appropriate metrics and pre-built model or build a new one,

• Gain access to the data, run the models, and evaluate the solution alternatives through a proof of concept, and

• Conduct preliminary business case analysis for the solution, and develop an implementation plan.

What might take months to complete, will take only weeks, in most cases with our process. The savings over other organizations is often substantial. Once a solution is determined, ACG can also assist in implementation. Determining the appropriate Key Performance Indicators (KPIs) is also part of our recommended solution.

Benefits to be Realized

• Reduce past due accounts, credit risk, and bad debt expense

• Lower Days Sales Outstanding (DSO) and increase cash flow

• Take full advantage of discounts and rebates

• Decrease dispute cycle time

• Mitigate any check fraud or errors in payment execution

• Improve the accuracy of cash forecasting

• Lower overall costs through improvements in processing productivity